12 May 2017

Don’t short change your staff – paying the national minimum wage

Adam Bernstein outlines some potential pitfalls that could put your practice on the HMRC's radar for being in breach of paying the national minimum wage.

It is clear some practices assume national minimum wage (NMW) rules do not apply to them.

This can be a mistake. In October 2015, a blog post on vettimes.co.uk discussed how night shifts and being on call could bring a VN’s pay well below the NMW threshold1.

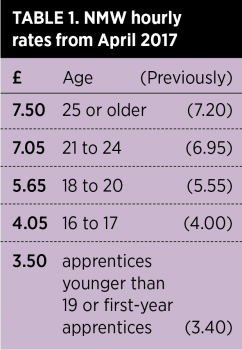

NMW – or the national living wage for those aged 25 or older – was introduced in 1999. The current rates are shown in Table 1.

Taxing calculations

Lee Ashwood, a senior associate in the employment department of Eversheds Sutherland, said you would think calculating NMW is simple, but it is not: “To most, the calculation would be pay divided by hours worked. Unfortunately, it is not that simple and this is often why employers inadvertently pay people less than the NMW.”

The first step, he said, is to note the calculation must be based on the relevant “pay reference period”.

However, not all pay in the reference period counts towards the calculation.

Mr Ashwood said: “A pay reference period is the period for which an employee receives pay, assuming they are paid regularly and at least once a month. For example, if someone is paid weekly, their pay reference period is one week. Employers then need to look at the total employees paid before deductions for income tax and NI contributions in the period in question (the relevant pay reference period), then remove any payments and deductions that do not count towards NMW.”

Basic salary, bonus, commission and other incentive payments based on performance all count towards NMW, as does, in some circumstances, an accommodation allowance.

But a number of elements of pay do not count, including pension payments or benefits in kind – such as private medical insurance or other benefits (except an accommodation allowance) – or any extra pay for overtime or shift work. Only the basic rate of pay is taken into consideration for overtime worked, expenses, and any allowances or payments not attributable to their performance not part of their basic salary – for example, an additional element of pay for London weighting or an on-call allowance. The amount left is the total amount paid for the purposes of NMW.

Establishing how many hours the employee worked is not simple, either, and employers need to consider the time spent working, but not any rest or meal breaks during which the employee is not required to work – even if they voluntarily do some work during the break.

Mr Ashwood added: “It’s also important to note standby or on-call time, but only if they are required to be available at, or near, their place of work should they be needed [the point made in the vettimes.co.uk post]; any travel time for business during normal working hours, but not commuting to and from work; and time the employee spends receiving training, whether at work or anywhere else during normal working hours.”

Crack down

To stay out of HMRC’s reach, Mr Ashwood advised employers to note these relevant factors when calculating NMW.

He said: “Remember, NMW is not going away. As the government minister responsible for NMW said: ‘This Government is determined to build an economy that works for everyone, not just the privileged few. That means making sure everyone gets paid the wages they are owed – including our new, higher, national living wage. So we’ll continue to crack down on those who ignore the law.’”